Today I want to share with you my knowledge about budgeting and tell you why it is particularly important to us students!

Okay, shall we define the budgeting concept first?

I like to keep things simple and straightforward. The budgeting is the process of planning your future income and expenses with goal to achieve a specific target. Of course it is pointless if you’re not taking right actions. Sounds complicated? J Let me give you an example. Let’s pretend you want to save up £500 pounds for you to travel around Europe. To achieve this, you need to have a detailed plan of your future income and expenses. Remember, your income should be more than your expenses so, you can save or invest the surplus.

Did you know?

Do you think you need to be a financial guru to do financial planning and budgeting? Of course not. Here is an interesting fact, even professional charted accountants are struggling to manage their personal budgets while successfully managing millions of pounds for companies. So, you wonder why, right? The thing is budgeting it’s not just a plan with list of rules, the most important part of any budget is discipline and great money records. You always should know where your money goes.

Why bother?

You may wonder, why do I need to do all this extra work, what for? Let me tell you few advantages of having the budget.

- Peace of mind.

You can sleep well that you have enough money to cover your daily living expenses. I think we all have been in a situation when accidentally we run out of money and we deep into our overdrafts and ending paying a lot in interest fees. So, to avoid spending more budget will be very handy and simple tool for you to use.

- Helps eliminate unnecessary expenses.

Your budget should be as detailed as possible so, you can follow it day by day. However, make sure you budget is flexible and suits your needs. Simple example would be you do groceries, you might have noticed when you went just to buy a pack sugar you end up with bunch of other staff you didn’t need to. So, to avoid unnecessary expenses follow your budget as closely as you can. Little advice from me try to use some amounts for unforeseen expenses. It is much better to plan for the worst and the best will happen. Be prepared for the worst case scenario.

- Can make the extra money work for you.

No matter what your goals are it never hurts to have extra money, right?

So, in your budget allocate some amount towards investment. This amount can be as little as £10, what is more important is continuity. If you not sure how to make money work harder for you, please check my previous article “How to invest your money successfully” (link to this article)

- Puts you in control.

The budget helps you to be in control of your finance not the other way around.

You want to control quality of your life and it can be achieved through discipline and finance planning. Try to predict how much you’re expecting to receive this month and how much you’re anticipating to spend. This simple method will help you to save some extra money.

- Planning orientation.

Budget helps to plan your life and everything that comes with it. When you’ll be in charge of your finance then you will see much bigger picture which will help you to get what you want to get. Remember I was talking about accountants in the introduction?

Logically, these people should be great at managing their own money. However, the truth is even top managers are struggling to make ends meet. The reasons for that, poor planning and bad money records. It doesn’t matter how much you earn, what’s matter is how much do you keep after.

How to manage budget?

- Try to keep it flexible.

The budget should help you to achieve desired quality of live not to make your life a living hell. Add entertainment, travel, hobby sections into your budget. We all people and we need to rest from our daily routine.

- Allocate extra time, it will pay off.

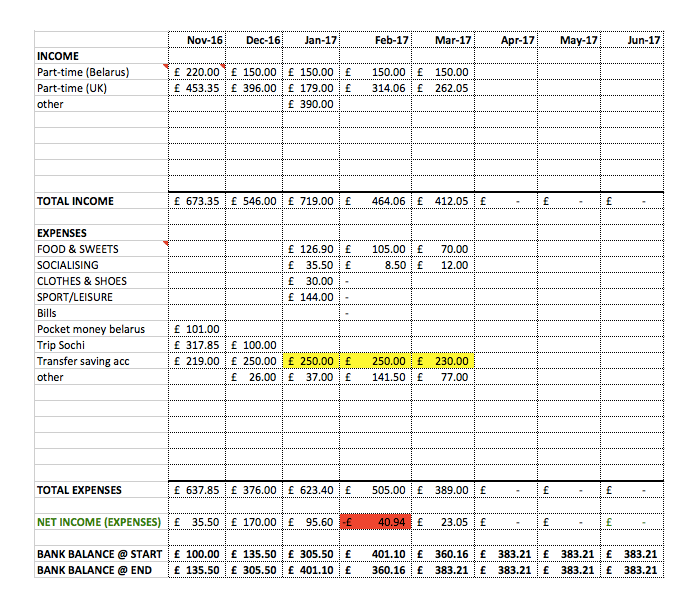

Your first budget might take some

time to design but don’t worry with time it will get easier and will become

natural thing as 2+2. I would say, on average the budget can be done within 2-3

hours, so it does not take that long. In addition, the advantages of having the

budget are well outweighs the energy spent on it. If you not sure where to

start please check my draft of the budget. Just for you to have an idea what it

looks like.

Useful budgeting apps and websites:

- Apps (iOS or Android):

- Spendee

- Spending Tracker (Nice and Easy interface)

- OnTrees Personal Finance (All your account in one place, very convenient)

Websites:

- Online budget planner

- How to budget

- Budget Tracker Buxfer.com (Group budgeting, invite your friends become smarter with your money)

What to do if you go over the budget?

- Do not panic.

Time to time we all go over the budget, it’s our human nature we cannot operate as a machine and quite often we do what we shouldn’t be doing. So, take a deep breath and check how much your budget have suffered from extra expenses you made. If your balance is still positive then it’s not the end of the world ;) If it became negative, try to negotiate an overdraft with you bank provider for this time being.

- Tighten your expenses.

If you‘ve noticed you over your budget try to minimize your expenses for the following month, so you can be back on track soon. Also, check if any expenses are really necessary may be some of them can be completely eliminated or minimized for the following month.

I hope you found this article useful, if you have any questions regarding this topic please let me know

See you on the next one!